A Timeless Investment: Why Used Luxury Watches Are a Smart Choice

While the term "investment" typically conjures images of stocks and real estate, any savvy investor agrees that certain tangible assets, such as used luxury watches, can also prove to be lucrative.

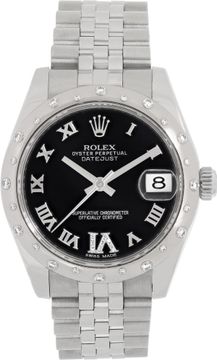

Now more than ever, the luxury watch market is booming and showing great returns. Watches such as Rolex, Breitling and Cartier are renowned for their quality craftsmanship and timeless design. They are produced in limited quantities, resulting in a scarcity that makes them highly sought after in the collector's market. The rarity of specific models, combined with the growing interest in watch collecting, consistently contributes to the upward trend in value.

In this blog post, we'll delve into the reasons why used luxury watches make for a compelling investment choice, shedding light on their enduring value and the unique characteristics that set them apart. We’ll also discuss some key considerations you should keep top-of-mind when building your portfolio.

The Timeless Appeal of Used Luxury Watches

If you’re considering getting into investing in used luxury watches, you first need to understand what makes them so valuable. There are several factors that contribute to the luxury watch market and make a case for a strong investment.

Historical Significance and Craftsmanship

Used luxury watches are not merely timekeeping devices that decorate your wrists and accessorize your outfits; they are artifacts that represent centuries of horological expertise and craftsmanship. Brands with a rich heritage, such as Omega and Patek Philippe, have consistently produced watches that stand the test of time. Investors recognize the historical significance of these timepieces and are drawn to their enduring quality.

Limited Production and Exclusivity

Many luxury watch brands intentionally limit the production of their timepieces to maintain a sense of exclusivity. As with any economy, limited availability often results in increased demand, making these watches more desirable among collectors. As a result, the scarcity of certain models contributes to their appreciation in value over time, offering investors the potential for substantial returns.

Classic Design and Timeless Aesthetics

Unlike trendy accessories that fall in and out of fashion with the fads and times, the design of luxury watches is often timeless. Their classic aesthetics and overall practicality ensure that they continue to remain desirable across generations. As a result, used luxury watches continue to hold their value, transcending short-lived trends.

The Financial Advantages of Investing in Used Luxury Watches

Now that we understand how the used luxury watch market works, let’s dive into the economics of why it can be a worthwhile investment.

Value Retention

One of the key attractions of investing in used luxury watches is their ability to retain value over the years. Unlike many consumer goods that depreciate rapidly, high-quality timepieces tend to hold their value and, in some cases, appreciate. This stability can be especially appealing to investors seeking a tangible asset with a track record of maintaining value.

Rarity Within Collector's Market

The secondary market for used luxury watches is a thriving ecosystem driven by collectors and enthusiasts. Limited production runs, discontinued models, and special editions contribute to the rarity of certain timepieces, making them highly sought after in the collector's market. Investors who understand this dynamic can capitalize on the demand for specific watches, potentially yielding impressive returns.

Global Market and Currency Hedge

The market for used luxury watches is global, with collectors and investors spanning across the globe. Investing in these timepieces can provide a hedge against currency fluctuations, as the value of sought-after watches is often insulated from economic volatility – unlike real estate or stocks. This global demand contributes to the resilience of luxury watches as a tangible investment.

Key Considerations for Investing In Used Luxury Watches

Investing in used luxury watches can be a rewarding endeavor, but it requires careful consideration and due diligence to ensure you get the most in returns. Here are some important factors to take into account when venturing into the world of investing in used luxury watches.

Research and Knowledge

Before making any investment, it's crucial to conduct thorough research. Familiarize yourself with different watch brands, models, and their histories. Understand the factors that contribute to the value of a watch, such as brand reputation, rarity, and historical significance. Research the watch market, making special note of how much the different watches are selling for, so you know their value and what profit you can make.

Condition and Authenticity

The condition of a used luxury watch significantly influences its value. Look for watches that are well-maintained, with minimal scratches and signs of wear. Verify the authenticity of the watch by checking for original documentation, serial numbers, and manufacturer markings. An original box and accompanying papers, such as warranty certificates and user manuals, add value to a used luxury watch. Consult experts or reputable dealers to ensure the watch is genuine.

Service History

A well-documented service history, including regular maintenance and any necessary repairs, can help you assess the watch's longevity and value. Ask for service records or consult with a professional watchmaker to evaluate the watch's mechanical integrity.

Conclusion

Luxury watches like Audemars Piguet are considered a viable investment due to their popularity, craftsmanship, and the financial advantages. As with any investment, it's crucial to conduct thorough research, seek expert advice, and stay informed about market trends.

Interested in investing in a used luxury watch? Build your watch investment portfolio with the help of Gray & Sons. Trusted for 40 years for our top-of-the-line used and pre-owned vintage wristwatches, Gray and Sons is here for you when you want to buy, trade and sell a preowned watch. We have competitive prices and all of our watches come with an exclusive 2-year warranty. Contact Gray and Sons to invest in a used watch today or sell us your jewelry.

Gray and Sons is a Proudly Unauthorized Independent vintage watch dealer dealing in pre-owned, used and unused vintage watches, and buying, selling and repairing vintage watches since 1980.

Why Should You Buy a Used Ulysse Nardin Luxury Watch

NEXT ARTICLE

The Top 10 Most popular Rolex watches