Pre-Owned IWC Watches and Luxury Timepieces: January 2026 Investment Portfolio Assets

As we enter January 2026, discerning collectors and investors are increasingly recognizing the enduring value of IWC watches and other luxury watches as sophisticated portfolio assets. The pre-owned luxury watch market has matured into a compelling investment avenue, combining horological excellence with tangible asset appreciation. Whether you're seeking mens luxury watches or exploring high end watches from prestigious luxury watch brands, understanding the investment potential of pre-owned timepieces has never been more relevant.

Gray & Sons has observed a remarkable shift in how collectors approach luxury watch acquisition. The stigma once associated with pre-owned timepieces has completely dissolved, replaced by an appreciation for the value, authenticity, and investment potential these watches offer. Our clients in Miami, Boca Raton, and throughout South Florida increasingly view certified pre-owned watches not merely as accessories, but as strategic additions to diversified investment portfolios.

Why Pre-Owned Luxury Watches Excel as January 2026 Investment Assets

The luxury watches market has demonstrated exceptional resilience throughout economic fluctuations, making it an attractive alternative investment class. Unlike new timepieces that depreciate immediately upon purchase, carefully selected pre-owned watches from brands like IWC, Rolex, and Patek Philippe often maintain or increase their value over time. This phenomenon stems from several factors: limited production runs, brand heritage, mechanical complexity, and growing global demand from emerging markets.

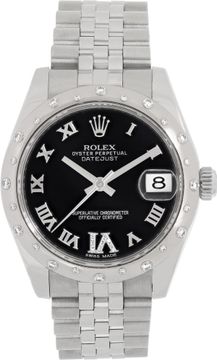

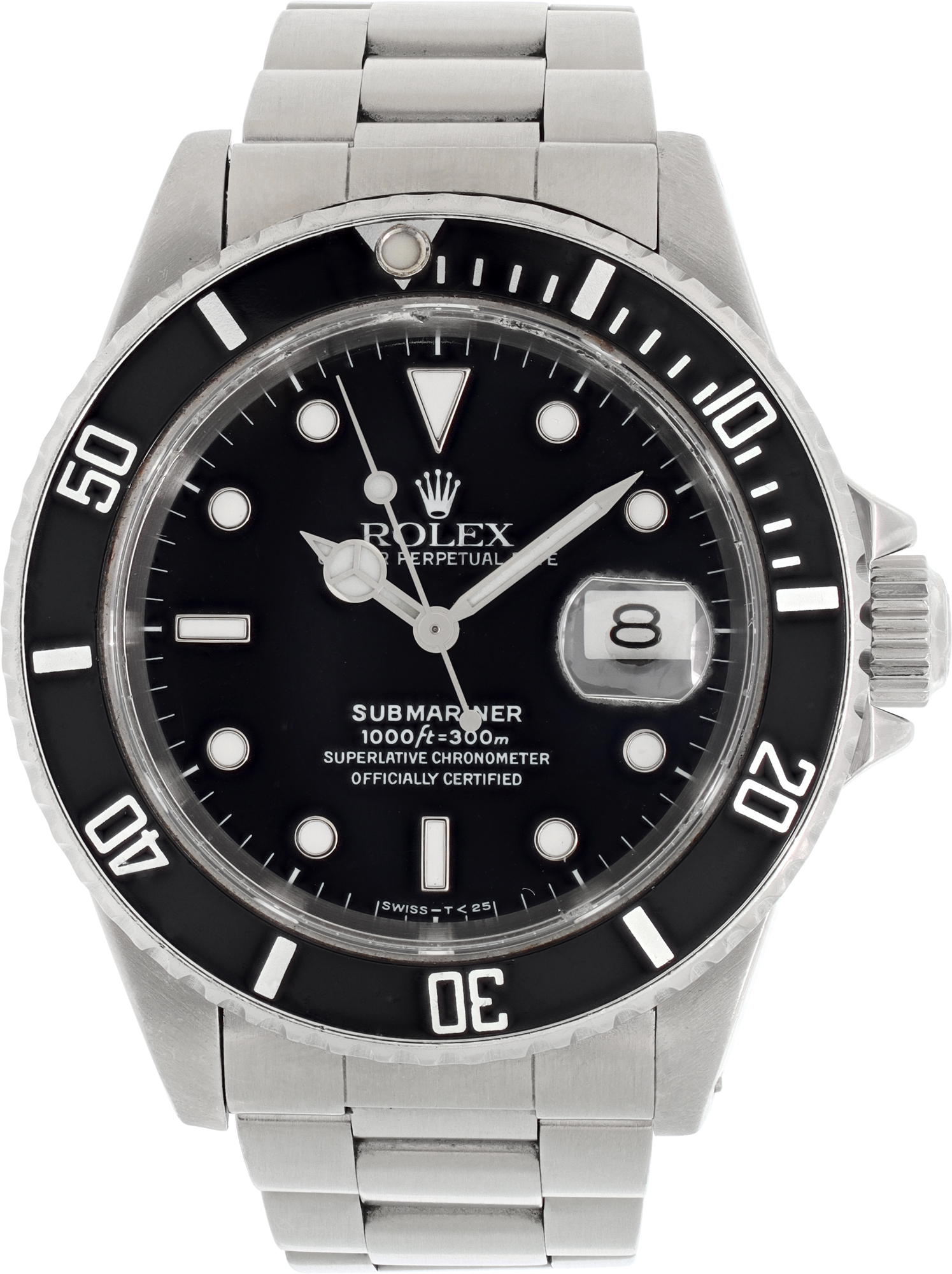

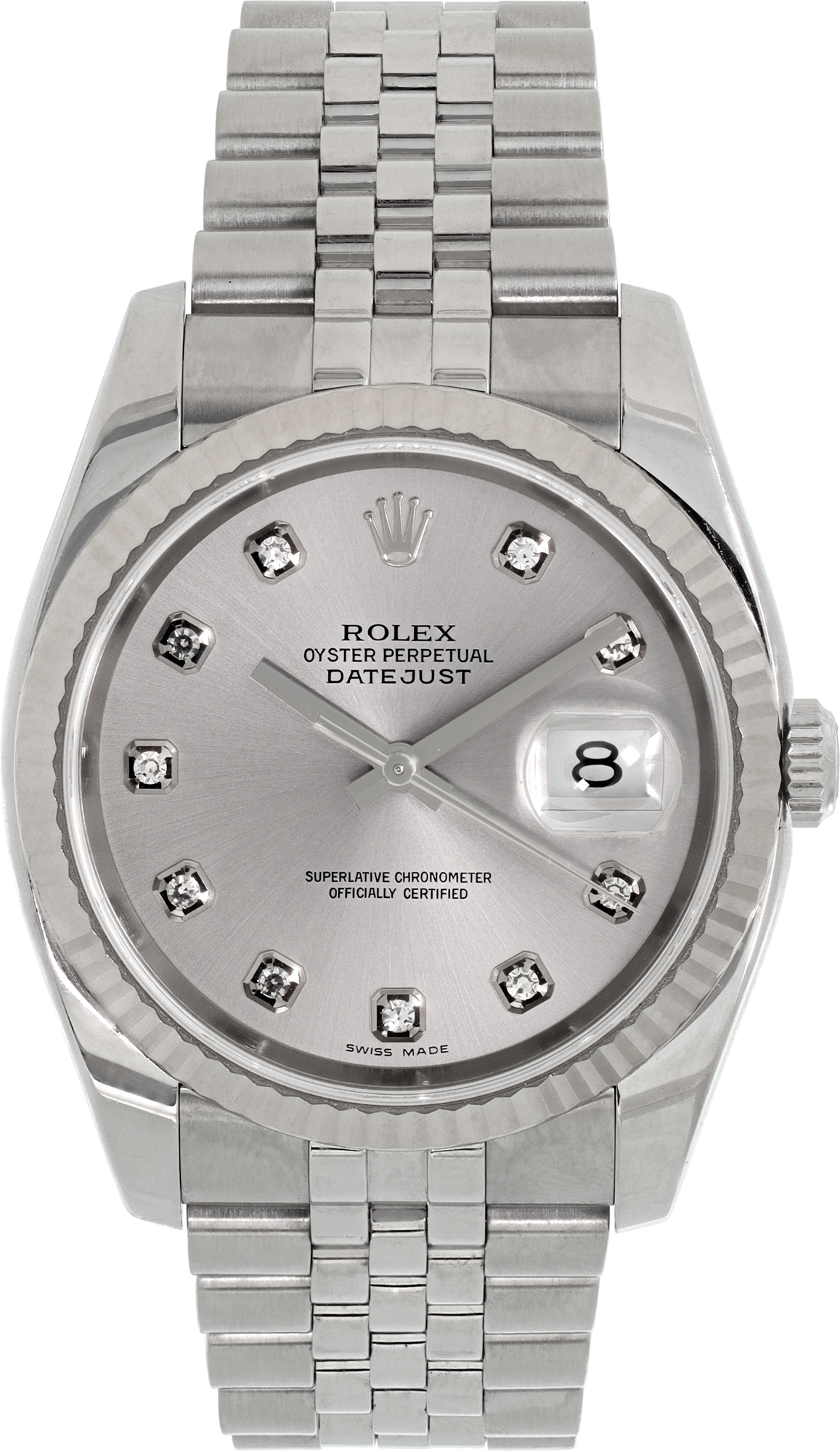

January traditionally marks a period when investors reassess their portfolios and explore alternative assets. IWC watches, particularly models from the Portugieser and Pilot collections, have shown consistent appreciation in the secondary market. The brand's commitment to in-house movements, exceptional finishing, and timeless design language ensures sustained collector interest. For those exploring used Rolex watches, the same principles apply—iconic models like the Submariner, Daytona, and Day-Date remain blue-chip investments in the horological world.

The Sophisticated Appeal of High-End Watches in Modern Portfolios

High end watches offer unique advantages as investment vehicles that few other collectibles can match. First, they're highly portable, requiring no special storage conditions beyond a quality watch winder. Second, they provide utility—unlike art or wine, you can enjoy wearing your investment daily. Third, the authentication and provenance verification processes have become increasingly sophisticated, reducing risk for buyers and sellers alike.

At Gray & Sons, we've curated an exceptional collection of mens luxury watches that exemplify investment-grade horology. Our inventory includes pristine examples from the world's most respected manufacturers, each piece thoroughly authenticated and restored to near-original condition by our master-trained watchmakers. From the elegant Vacheron Constantin Overseas 42040 in stainless steel to the refined Piaget Dancer G0A31158 in 18k yellow gold, these timepieces represent the pinnacle of horological craftsmanship.

The current market dynamics favor educated buyers who understand value beyond brand recognition. Consider the Breguet Marine Big Date in 18k rose gold, priced at $16,500. This exceptional timepiece from one of horology's most historically significant brands offers tremendous value compared to retail pricing on similar complications. Such opportunities exemplify why January 2026 presents an ideal moment for portfolio diversification into luxury timepieces.

Featured Investment-Grade Timepieces Available Now

Our current inventory showcases several remarkable opportunities for collectors and investors seeking to enter or expand their horological holdings. The market for pre owned Rolex watches remains exceptionally strong, with certain models experiencing significant appreciation. The Rolex Submariner 16610 in stainless steel with black dial, priced at $12,500, represents a classic investment—this reference's production ended years ago, and demand continues to outpace supply.

For those seeking precious metal Rolex models, the Rolex Day-Date 1803 in 18k yellow gold with silver dial exemplifies timeless Presidential elegance at $18,000. This vintage reference from the 1960s-70s era features the iconic President bracelet and day-date complication that made this model the choice of world leaders and industry titans. Similarly, the Rolex Daytona 116523 in steel and gold, complete with box and papers, offers chronograph functionality and undeniable investment potential at $22,900.

Beyond Rolex, sophisticated collectors recognize value in brands like Omega, particularly their legendary Speedmaster line. The Omega Speedmaster 3523.80.00 in stainless steel, priced at just $3,950, offers exceptional value for a 39mm automatic chronograph from this storied collection. For sports watch enthusiasts, the Tag Heuer Aquaracer way2013 delivers robust 43mm sizing and automatic Calibre 5 movement at an accessible $2,500 price point.

Expert Insights: Maximizing Value in Pre-Owned Watch Investments

According to Gray & Sons' expert watchmakers and vintage timepiece specialists, several key factors determine a watch's investment potential. Condition remains paramount—original components, minimal refinishing, and complete service history significantly impact value. Documentation including original box, papers, and service records can add 20-30% to a timepiece's worth. Provenance matters, particularly for vintage pieces with interesting ownership history or limited production numbers.

Our master watchmakers recommend considering movement quality and servicing requirements when evaluating investment watches. Complex complications like perpetual calendars, minute repeaters, or tourbillons command premium prices but also require specialized maintenance. For many investors, time-and-date automatic movements from brands like IWC, Rolex, and Omega offer the optimal balance of reliability, serviceability, and value retention. This philosophy guides our watch repair services, where we maintain the highest standards of horological restoration.

Market timing also influences investment returns. January through March typically sees increased buying activity as high-net-worth individuals allocate capital following year-end financial planning. However, the most successful watch investors focus on long-term holdings rather than short-term speculation. A quality Rolex Submariner or IWC Portugieser held for 5-10 years will likely outperform most traditional investments while providing daily enjoyment and utility.

Complementary Luxury: Fine Jewelry as Portfolio Diversification

While watches represent our primary focus, savvy investors recognize that high end jewelry offers complementary portfolio diversification. Estate jewelry pieces often contain intrinsic precious metal and gemstone value while also commanding premiums for design, craftsmanship, and provenance. The Nanis 18k yellow gold heart motif diamond cocktail ring at $3,500 exemplifies this dual appeal—featuring quality diamonds and distinctive Italian design.

Gentlemen's accessories also merit consideration for comprehensive luxury portfolios. The Lapis Lazuli 18k white gold cufflinks with diamonds, priced at $2,500, showcase museum-quality craftsmanship in a wearable format. Similarly, designer pieces from David Yurman offer recognition and resale value—the David Yurman Spiritual Beads Bracelet with Onyx at $295 represents accessible luxury from this celebrated American designer.

Estate jewelry provides unique opportunities for value acquisition. The European cut diamond ring set in 14K white gold features over 1.10 carats of diamonds in a vintage setting, priced at $2,950—significantly below comparable new jewelry costs. For colored stone enthusiasts, the ring in 18k white gold with diamonds and carré cut blue sapphires offers elegant Art Deco-inspired design at $2,450.

Authenticating and Maintaining Your Luxury Watch Investment

At Gray & Sons, we understand that buying pre owned luxury watches requires absolute confidence in authenticity and condition. Our rigorous authentication process examines every aspect of a timepiece: movement serial numbers, case hallmarks, dial printing, hand finishing, bracelet construction, and overall originality. We guarantee the authenticity of every watch we sell, backed by decades of expertise and our reputation as South Florida's premier luxury watch dealer.

Proper maintenance preserves and enhances investment value. Most mechanical watches require servicing every 3-5 years, involving complete disassembly, cleaning, lubrication, and regulation. Our jewelry repair and watch restoration services employ master craftsmen trained in Swiss techniques, ensuring your timepieces receive the care they deserve. Regular servicing not only maintains functionality but also documents the watch's care history—valuable information for future buyers.

For IWC owners, we maintain an extensive inventory of authentic straps and accessories. The IWC brown alligator strap 20mm x 18mm at $1,250 exemplifies the quality replacements available. We also stock more accessible options like the IWC Black Calf Strap IWE14172 at $275, allowing collectors to maintain their watches' presentation without compromising authenticity. These genuine components preserve value far better than aftermarket alternatives.

The Gray & Sons Advantage: Four Decades of Horological Excellence

Since 1980, Gray & Sons has built our reputation on providing exceptional pre-owned luxury timepieces and estate jewelry to discerning collectors. Our Surfside showroom, conveniently located across from the iconic Bal Harbour Shops, welcomes clients throughout Miami-Dade, Broward, and Palm Beach counties. We invite you to visit our showroom and experience firsthand the quality and expertise that distinguish Gray & Sons from ordinary jewelry retailers.

Our business model prioritizes long-term client relationships over transactional sales. Whether you're selling or trading luxury watches or building your collection, our team provides personalized guidance based on your specific goals. We offer consignment services for high-value timepieces, ensuring maximum returns for sellers while providing buyers access to exceptional pieces. Our constantly updating inventory means new opportunities arrive daily—explore our digital catalog or request our physical catalog to stay informed about recent acquisitions.

For clients seeking specific models or brands, our network extends throughout the United States and internationally. We locate hard-to-find references, verify authenticity, and negotiate fair pricing on your behalf. This concierge approach has made Gray & Sons the trusted source for luxury watches in Miami, Boca Raton, Fort Lauderdale, West Palm Beach, and beyond. Our client testimonials speak to the white-glove service we provide every customer, regardless of purchase size.

January 2026 Market Outlook and Future Predictions

The luxury watch market enters 2026 with robust fundamentals supporting continued growth. Global wealth expansion, particularly in Asia and the Middle East, drives sustained demand for prestigious timepieces. Meanwhile, production constraints at top manufacturers—Rolex, Patek Philippe, Audemars Piguet—ensure the pre-owned market remains the only viable source for many desirable models. This supply-demand imbalance favors current holders of investment-grade watches.

Younger collectors increasingly appreciate mechanical watches' craftsmanship and history, viewing them as antidotes to digital ephemera. This generational shift supports long-term market stability—watches transcend mere timekeeping to become wearable expressions of personal taste, technical appreciation, and wealth preservation. Brands like IWC, with their focus on in-house movements and traditional watchmaking, benefit enormously from this trend toward authenticity and permanence.

Gray & Sons anticipates continued strength in sports models from Rolex (Submariner, GMT-Master II, Daytona), elegant dress watches from Patek Philippe and Vacheron Constantin, and technical achievements from IWC and A. Lange & Söhne. The Vacheron Constantin Classic 4894 in 18k yellow gold at $5,950 represents exactly the type of undervalued classic we expect to appreciate significantly. Similarly, vintage Omega Constellation models like the Omega Constellation 14381/2 in 18k gold offer compelling value at $6,750.

Frequently Asked Questions About Luxury Watch Investments

What makes IWC watches particularly suitable as investment pieces in 2026?

IWC Schaffhausen combines prestigious Swiss heritage dating to 1868 with innovative technical developments and relatively moderate pricing compared to brands like Patek Philippe or Audemars Piguet. Their Portugieser, Pilot, and Portofino collections feature in-house movements, exceptional finishing, and timeless designs that appeal to collectors worldwide. Limited production numbers and strong brand recognition ensure IWC watches maintain value while offering everyday wearability.

How do pre-owned Rolex watches compare to new ones as investments?

Pre-owned Rolex watches often present superior investment opportunities compared to retail purchases. New Rolex models experience immediate depreciation upon sale, while carefully selected pre-owned examples have already absorbed this initial loss. Certain vintage and discontinued references—particularly sports models like the Submariner, GMT-Master, and Daytona—have demonstrated exceptional appreciation. The Rolex Submariner 16613 in steel and gold at $14,950 exemplifies a model poised for continued value growth.

What should I consider when evaluating luxury watch pricing and value?

Several factors determine fair market value: brand prestige, model desirability, condition (including originality of components), completeness (box, papers, accessories), service history, and market trends. Rare complications, precious metal cases, and limited editions command premiums. Gray & Sons prices reflect current market conditions while offering competitive value for collectors. Our expertise ensures accurate authentication and fair pricing—essential protections in the luxury watch market.

How important is professional watch servicing for maintaining investment value?

Professional maintenance is crucial for preserving mechanical watches' functionality and value. Regular servicing every 3-5 years prevents wear-related damage and ensures optimal performance. Documented service history from authorized dealers or qualified watchmakers significantly enhances resale value. At Gray & Sons, our watch repair services employ master watchmakers trained in Swiss techniques, providing the quality maintenance your investment timepieces deserve. We maintain detailed service records that accompany watches when sold.

Can I customize my luxury watch with aftermarket straps while preserving value?

Using high-quality, brand-authentic straps maintains or even enhances value by offering versatility without permanently modifying the watch. Gray & Sons stocks genuine IWC straps including the IWC Dark Blue Alligator Strap at $300 and the IWC Pilot Brown Calf Strap at $275. We recommend preserving original straps and bracelets even when wearing alternatives. Avoid permanent case modifications, dial refinishing, or aftermarket components—these dramatically reduce collector value.

Enhancing Your Luxury Experience with Gray & Sons

Gray & Sons represents more than a luxury watch dealer—we're your partner in building meaningful collections that provide enjoyment, prestige, and financial return. Our inventory spans the spectrum of fine horology, from accessible vintage timepieces to six-figure complications. Every piece undergoes rigorous authentication and restoration by our expert team, ensuring you receive museum-quality items backed by our reputation and guarantee.

Beyond sales, Gray & Sons offers comprehensive services supporting luxury watch collectors. Our master watchmakers provide expert maintenance, restoration, and repair for virtually all prestigious brands. We accept consignments for exceptional timepieces, providing professional marketing and global exposure. For those divesting collections or individual pieces, our purchasing team offers fair, immediate payment based on current market values. This full-service approach has made Gray & Sons South Florida's trusted luxury watch source for over four decades.

We invite you to experience the Gray & Sons difference firsthand. Browse our fine luxury watches online, exploring our extensive inventory of authenticated pre-owned timepieces. Subscribe to our newsletter for updates about new acquisitions and market insights. Better yet, visit our Surfside showroom to examine pieces personally, discuss your collecting goals, and discover why generations of Miami-area collectors trust Gray & Sons for their most important horological purchases.

Stay Connected with South Florida's Premier Luxury Watch Dealer

January 2026 presents exceptional opportunities for collectors and investors seeking to acquire investment-grade timepieces at fair market values. Whether you're drawn to the sophisticated elegance of IWC watches, the iconic status of Rolex, or the technical brilliance of independent manufacturers, Gray & Sons provides the expertise, inventory, and service supporting successful luxury watch collecting.

Our commitment extends beyond individual transactions to building lasting relationships with clients who share our passion for fine horology. We encourage you to contact us with questions about specific models, market conditions, or collecting strategies. Our knowledgeable team welcomes the opportunity to assist whether you're making your first luxury watch purchase or adding to an established collection.

Ready to explore investment-grade timepieces? Visit our pre-owned luxury watches collection today or schedule an appointment at our Surfside showroom. For those considering selling or trading watches, contact our acquisition team for a confidential evaluation. Subscribe to our newsletter to receive updates about new inventory and exclusive opportunities. Experience the Gray & Sons difference—where horological passion meets investment expertise.

Pre-Owned Patek Philippe, Rolex, and Roger Dubuis New Arrivals – January 7, 2026

NEXT ARTICLE

Discover Pre-Owned Luxury: New Arrivals & Limited-Time Deals at Gray and Sons – January 6, 2026