Pre-Owned Rolex Daytona Investment Excellence: January 2026 Portfolio Assets

As we step into January 2026, discerning investors and watch collectors are increasingly recognizing the Rolex Daytona as a premier investment asset. The pre-owned luxury watch market continues to demonstrate remarkable resilience and growth potential, with certain timepieces consistently outperforming traditional investment vehicles. Among these exceptional instruments, the pre-owned Rolex Daytona stands as a cornerstone of portfolio excellence, combining horological mastery with proven value appreciation.

The Rolex Daytona represents more than just a chronograph—it embodies decades of racing heritage, technical innovation, and unmistakable prestige. For those seeking to diversify their investment portfolios in 2026, acquiring a used Rolex Daytona presents an opportunity to own a tangible asset with a distinguished track record of value retention and appreciation.

The Investment Case for Pre-Owned Rolex Daytona Watches

The market for luxury watches has evolved significantly over the past decade, with sophisticated collectors and investors recognizing the unique advantages of pre-owned timepieces. Unlike new watches that depreciate immediately upon purchase, carefully selected pre-owned Rolex models, particularly Daytonas, have demonstrated consistent appreciation. The current market dynamics favor those who understand the nuances of model variations, production years, and condition grades.

Historical data reveals that certain Rolex Daytona references have appreciated by double-digit percentages annually, outpacing many conventional investment instruments. This performance stems from Rolex's controlled production, enduring brand prestige, and the Daytona's iconic status within the watchmaking world. For investors in Miami and beyond, the rolex for sale market offers exceptional opportunities, particularly when working with established dealers who guarantee authenticity and condition.

Gray & Sons' expertise in curating exceptional timepieces ensures that every investment watch in our collection meets the highest standards. Our master-trained watchmakers meticulously inspect each piece, verifying authenticity and, when necessary, restoring watches to near-original condition using only genuine Rolex components.

Featured Investment-Grade Rolex Daytonas for January 2026

Our current collection showcases several exceptional Rolex watches for sale miami collectors and investors should consider. The Rolex Daytona 116523 in stainless steel with white dial, priced at $22,900, represents an excellent entry point into Daytona ownership. This 40mm automatic chronograph combines the durability of stainless steel with the warmth of 18k gold accents, creating a versatile timepiece suitable for both daily wear and investment purposes.

For those seeking precious metal excellence, the Rolex Daytona in 18k yellow gold on a brown alligator strap exemplifies sophisticated luxury at $27,500. The warmth of yellow gold paired with the refined elegance of an alligator strap creates a timepiece that commands attention while maintaining the understated sophistication Rolex is renowned for. This 40mm automatic model represents exceptional value for collectors seeking full gold construction.

The pinnacle of our current offerings is the Rolex Daytona 16519 in 18k white gold with a mesmerizing mother-of-pearl dial, priced at $42,000. This 40mm automatic masterpiece combines the understated luxury of white gold with the ethereal beauty of natural mother-of-pearl, creating a timepiece that transcends mere functionality to become wearable art. Complete with box and papers, this example represents museum-quality collecting.

Vintage Rolex Daytona: The Ultimate Investment Assets

For serious collectors and investors, vintage Rolex Daytonas occupy a category unto themselves. The Rolex Daytona 6262 in stainless steel, a 37mm manual-wind masterpiece priced at $87,000, represents the golden era of Rolex chronographs. These manually-wound references from the 1960s and 1970s have become increasingly scarce, driving values upward as collectors compete for well-preserved examples.

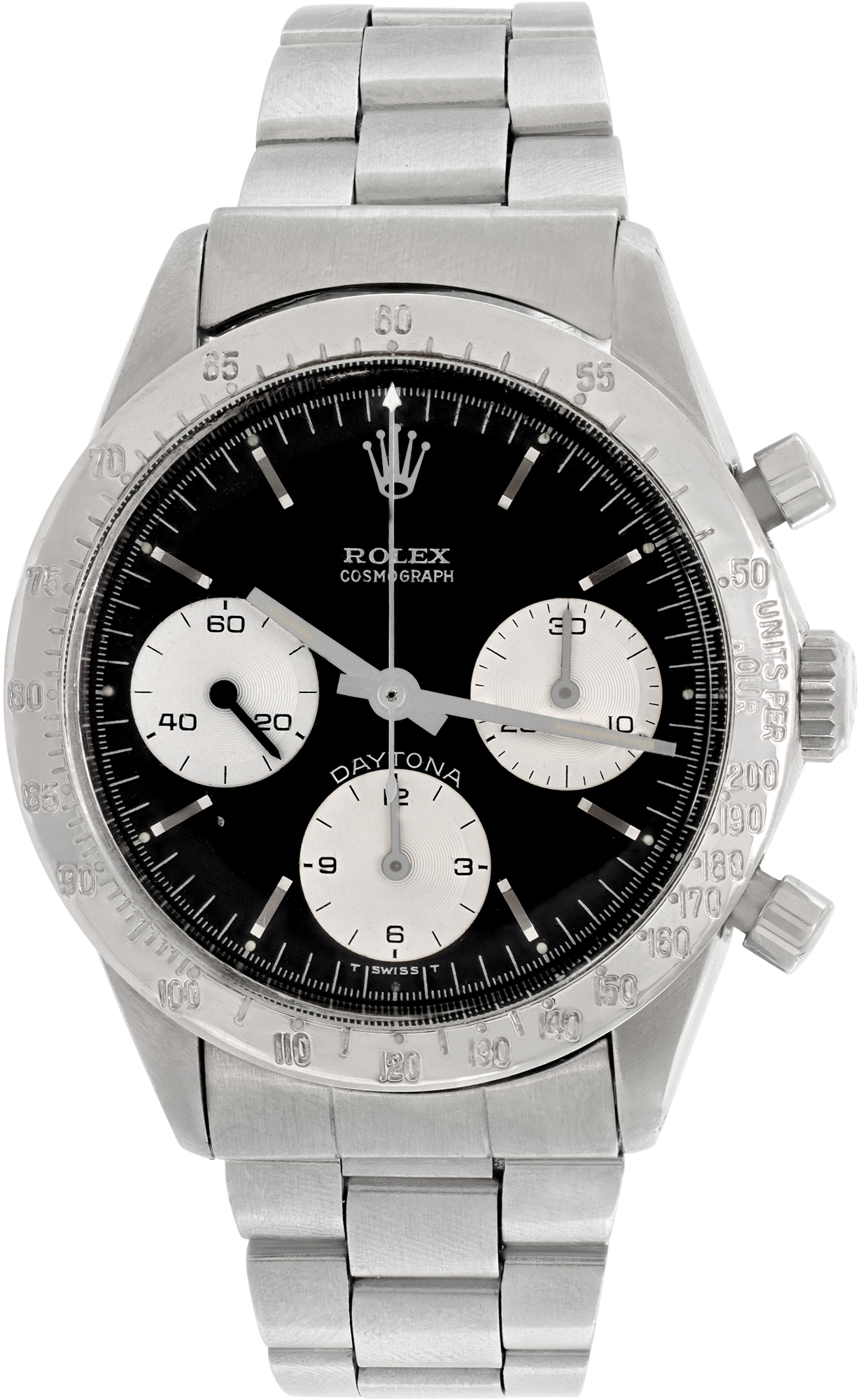

Perhaps the most iconic of all is the Rolex Daytona 6239 with black dial, offered at $92,000. This 36mm manual-wind reference represents the original Daytona design, worn by racing legends and cherished by collectors worldwide. The 6239's clean aesthetic, manually-wound movement, and historical significance make it a cornerstone piece for any serious collection. As authentic examples become increasingly rare, values for these vintage watches continue their upward trajectory.

These vintage models represent not just timepieces, but tangible connections to automotive racing history and horological innovation. Each carries stories of the race tracks, the drivers who wore them, and the evolution of chronograph technology that defined an era.

Market Dynamics and Investment Strategy for 2026

Understanding the rolex watches for sale miami market requires insight into both local and global dynamics. Miami's position as an international hub for luxury goods creates a unique marketplace where discerning buyers from across the Americas and beyond seek exceptional timepieces. The city's sophisticated collector community and robust pre-owned market infrastructure provide both liquidity and competitive pricing.

Investment strategies for 2026 should focus on several key factors: reference rarity, condition grade, provenance documentation, and market timing. Models with box and papers command premium prices and demonstrate superior value retention. References discontinued by Rolex often experience accelerated appreciation as availability diminishes. The current market favors both precious metal models and stainless steel sports references, each appealing to different collector demographics.

Geographic considerations also influence investment decisions. The rolex for sale miami beach market benefits from international exposure, tax advantages for certain buyers, and proximity to Latin American collectors. This positions South Florida dealers like Gray & Sons advantageously for both acquisitions and sales.

Expert Authentication and Certification Standards

When acquiring investment watches, authentication and condition verification are paramount. Gray & Sons' decades of experience in the pre-owned luxury market ensure that every timepiece undergoes rigorous evaluation. Our master watchmakers examine movements, cases, dials, and bracelets, verifying authenticity of every component. This meticulous process protects buyers from the growing threat of sophisticated counterfeits while ensuring accurate grading.

For collectors seeking to sell or trade-in their watch, our expertise provides fair market valuations based on current auction results, dealer networks, and retail market trends. Our consignment program offers sellers access to our extensive buyer network while maintaining competitive terms. This bidirectional market participation gives Gray & Sons unique insight into real-time market dynamics.

All timepieces requiring attention receive service from our certified watchmakers using genuine parts. However, many examples in our inventory arrive in exceptional condition, requiring only authentication and evaluation before offering to collectors. Our commitment to transparency means buyers receive comprehensive condition reports detailing any service history or restoration work performed.

Portfolio Diversification Through Luxury Timepieces

Modern investment portfolios increasingly incorporate alternative assets, with luxury watches representing a compelling category. Unlike traditional securities, fine timepieces offer tangible ownership, personal enjoyment, and inflation protection. The used rolex market specifically provides liquidity advantages over many collectibles, with established dealer networks and auction houses facilitating transactions.

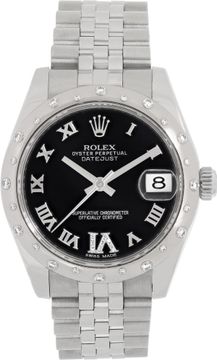

Diversification within watch collecting itself merits consideration. While Daytonas form an excellent foundation, complementing them with other Rolex watches models creates balanced exposure. Our collection includes exceptional Rolex Datejust models ranging from vintage references to contemporary pieces, each offering distinct investment characteristics.

The Rolex Day-Date President in 18k yellow gold with silver dial at $18,000 represents presidential prestige and solid value. Similarly, the Rolex Sea-Dweller 116600 in stainless steel at $13,250 appeals to sports watch collectors while offering excellent wearing versatility. These complementary pieces create portfolio depth while maintaining the Rolex brand focus that drives market liquidity.

Care, Maintenance, and Value Preservation

Protecting your investment requires understanding proper care and maintenance protocols. Rolex recommends service intervals of approximately 10 years for modern movements, though vintage pieces may require more frequent attention. Gray & Sons offers comprehensive watch repair services performed by certified technicians, ensuring your timepieces maintain both functionality and value.

Proper storage protects against environmental damage, with watch winders maintaining automatic movements and preventing lubricant stagnation. Documentation preservation proves crucial—original boxes, papers, and service records significantly impact market values. Buyers should maintain organized records of purchase documentation, service history, and any provenance information accompanying their timepieces.

Insurance coverage provides essential protection for valuable watch collections. Specialized policies tailored for high-value timepieces offer agreed-value coverage, protecting against loss, theft, and damage. Regular appraisals ensure coverage keeps pace with market appreciation, a particular concern for rapidly appreciating models like vintage Daytonas.

Miami's Luxury Watch Market Advantage

South Florida's position as a luxury goods destination creates unique advantages for watch collectors and investors. The region's international character attracts buyers from throughout the Americas, Europe, and Asia, creating dynamic market conditions. Miami Beach, Coral Gables, Fort Lauderdale, and Boca Raton each host sophisticated collector communities supporting robust pre-owned rolex markets.

Our Surfside showroom, conveniently located across from the prestigious Bal Harbour Shops, provides an ideal venue for serious collectors. Here, clients can examine timepieces personally, consult with our experts, and experience the quality that has defined Gray & Sons since 1980. We invite collectors to visit our showroom and explore our exceptional inventory firsthand.

The Miami market also benefits from favorable tax considerations and proximity to Latin American collectors, many of whom maintain second homes or businesses in South Florida. This international character creates liquidity and competitive pricing rarely found in other American markets.

Current Market Opportunities and Future Outlook

As we navigate 2026, several trends shape the investment watches market. Increasing mainstream awareness of watches as alternative investments continues driving demand, particularly for iconic models like the Daytona. Younger collectors entering the market bring fresh perspectives and robust buying power, supporting continued appreciation for blue-chip references.

Supply constraints persist as Rolex maintains careful production control. The secondary market therefore becomes increasingly important for accessing desired models, particularly discontinued references and vintage pieces. This dynamic supports value retention while creating opportunities for knowledgeable buyers who understand reference nuances and condition grading.

Technological advances in authentication and condition documentation improve market transparency, benefiting serious collectors while challenging counterfeiters. Blockchain-based provenance tracking and advanced imaging techniques may revolutionize the pre-owned market, though traditional expertise remains irreplaceable for nuanced evaluation.

Gray & Sons: Your Partner in Luxury Watch Investment

Since 1980, Gray & Sons Jewelers has built our reputation on providing exceptional pre-owned watches, meticulous restoration services, and expert guidance. Our team of master watchmakers and jewelry specialists ensures every piece meets the highest standards before offering it to clients. Daily inventory additions mean our digital catalog constantly features fresh acquisitions, providing regular opportunities for discerning collectors.

Our commitment extends beyond transactions to building lasting relationships with collectors. Whether you're beginning your watch journey or expanding an established collection, our expertise guides you toward informed decisions. We understand that acquiring a significant timepiece represents both an emotional and financial commitment, and we treat every client interaction with the professionalism and respect it deserves.

For those who prefer reviewing inventory at leisure, we offer a physical catalog request service, delivering our latest offerings directly to you. Alternatively, subscribe to our newsletter for regular updates on new arrivals, market insights, and collecting tips curated by our expert team.

FAQ

What makes the Rolex Daytona such a strong investment watch?

The Rolex Daytona combines several factors that drive investment value: iconic status within watchmaking history, controlled production creating scarcity, universal brand recognition ensuring liquidity, and proven appreciation across multiple decades. Historical racing heritage, technical innovation, and enduring aesthetic appeal create sustained demand from both collectors and investors. Our pre-owned Rolex collection features exceptional Daytona examples demonstrating these investment characteristics.

How do I verify the authenticity of a pre-owned Rolex Daytona?

Authenticating luxury timepieces requires expertise in movement examination, case construction, dial characteristics, and bracelet/clasp details. Every Rolex component should display manufacturing quality consistent with the brand's standards. At Gray & Sons, our master watchmakers verify authenticity of every piece, examining movements under magnification, checking serial numbers against Rolex databases, and confirming original parts throughout. We guarantee authenticity of all timepieces sold, providing buyers confidence in their acquisitions.

What price range should I expect for investment-grade Rolex Daytonas?

Investment-grade Daytonas span a wide range depending on reference, materials, condition, and rarity. Contemporary stainless steel and two-tone models typically range from $20,000 to $35,000, precious metal examples from $30,000 to $50,000, and vintage references from $60,000 to well over $100,000 for exceptional pieces. Our current inventory includes the Rolex Daytona 116523 at $22,900, offering excellent entry-level investment opportunity, through to the vintage 6239 at $92,000, representing pinnacle collecting.

How should I maintain my Rolex Daytona to preserve its investment value?

Proper maintenance preserves both function and value. Service your Daytona per Rolex recommendations—typically every 10 years for modern movements, potentially more frequently for vintage pieces. Store your watch properly when not wearing it, protect it from impacts and extreme conditions, and maintain all original documentation including boxes, papers, and service records. Gray & Sons provides expert watch repair services performed by certified technicians using genuine Rolex parts, ensuring your timepiece maintains its value and performance.

Can I customize my Rolex Daytona without affecting its investment value?

Most customizations negatively impact investment value, as collectors prefer original configurations. However, period-correct strap changes using quality materials can enhance versatility without harming value. We offer various Rolex watch bands, including a custom burgundy alligator strap for Daytonas, allowing personalization while preserving original bracelets. Always retain factory bracelets and components, as these significantly affect resale values.

Enhancing Your Luxury Portfolio Experience

Gray & Sons' expertise extends beyond timepieces to comprehensive luxury jewelry services. Our collection includes exceptional estate pieces, contemporary designs, and custom creations crafted by master jewelers. Whether seeking complementary accessories for your watch collection or diversifying into fine jewelry investments, our Surfside showroom presents curated selections meeting the same exacting standards we apply to horology.

For clients building comprehensive luxury portfolios, we offer consultation services addressing both acquisition strategies and collection management. Our decades of market experience provide insights into trends, valuations, and opportunities across both watches and jewelry. This holistic approach helps clients maximize both enjoyment and investment returns from their luxury acquisitions.

We also maintain strong relationships with collectors internationally, facilitating both buying and selling opportunities within a network of serious enthusiasts. This community aspect enhances the collecting experience while providing access to pieces rarely appearing in public markets.

Begin Your Investment Journey Today

The start of 2026 presents an ideal moment to add investment-grade timepieces to your portfolio. Whether you're drawn to contemporary Daytonas offering immediate wearability or vintage references representing horological history, Gray & Sons provides the expertise, inventory, and service supporting successful collecting.

Explore our exceptional collection of Rolex Daytona watches today. Visit our showroom in Surfside, across from Bal Harbour Shops, to experience these remarkable timepieces firsthand. Our expert team stands ready to guide you toward acquisitions that align with both your aesthetic preferences and investment objectives.

For immediate assistance or to inquire about specific references, contact our team directly. We're committed to helping you build a watch collection that provides both personal satisfaction and portfolio performance as we progress through 2026 and beyond.

Lunar Legacy for 2026: Pre-Owned Omega Speedmaster Professional Excellence for New Year Collecting Goals

NEXT ARTICLE

Pre-Owned Cartier, Breitling, and Hublot Watches Plus Diamond Jewelry New Arrivals – December 29, 2024