Why Pre-Owned Luxury Watches Are a Smart Investment

One often overlooked yet highly rewarding avenue is the world of pre-owned luxury timepieces. At Gray & Sons Jewelers, we’ve seen firsthand how these exquisite timepieces not only serve as symbols of status and style but also as valuables that appreciate over time. Here’s why investing in pre-owned watches is a smart decision.

The Timeless Appeal of Pre-Owned Luxury Watches

Patek Philippe Annual Calendar

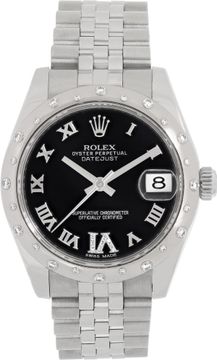

Luxury watches have an inherent timeless appeal. Brands like Rolex, Patek Philippe, Audemars Piguet, and Cartierhave established themselves as icons of craftsmanship, precision, and elegance. These brands have been around for decades, some even centuries, and have built reputations that are synonymous with quality and prestige. The allure of owning a piece of this history is undeniable, making luxury watches highly desirable.

Retained and Appreciated Investment Value

Unlike many consumer goods that depreciate as soon as they leave the store, luxury watches often retain or even appreciate in value over time. This is particularly true for pre-owned timepieces, which can be purchased at a lower price point compared to brand-new models. Over the years, certain watches have seen significant increases in value due to their rarity, demand, and condition.

For example, vintage and used Rolex watch models, especially those with unique features or limited production runs, have become highly sought after in the collector’s market. The Rolex Daytona, particularly the Paul Newman model, is a prime example of a watch that has seen exponential growth in value. What was once an attainable timepiece has now become a multimillion-dollar collector's item.

Scarcity and Exclusivity

Cartier Ballon Bleu in 18k rose gold

One of the key factors driving the value of luxury watches is their scarcity. Limited edition models, discontinued lines, and watches with unique characteristics often become more valuable as they become harder to find. Collectors and enthusiasts are always on the lookout for these rare pieces, willing to pay a premium to add them to their collections.

Furthermore, the exclusivity of certain brands and models adds to their allure. Owning a luxury watch that is no longer in production or is part of a limited series gives a sense of distinction and exclusivity. This scarcity and exclusivity contribute to the potential of second-hand watches.

Quality and Craftsmanship

Luxury watches are renowned for their exceptional quality and craftsmanship. Luxury brands like Patek Philippe and Audemars Piguet are known for their meticulous attention to detail and the use of high-quality materials. These timepieces are built to last, often passed down through generations as cherished heirlooms. The durability and longevity of luxury watches make them not only reliable timekeepers but also enduring investments.

The craftsmanship involved in creating these watches ensures that they remain functional and aesthetically pleasing for decades. Many luxury watches undergo rigorous testing and quality control processes, ensuring that each piece meets the highest standards of precision and performance. This commitment to excellence is one of the reasons why pre-owned watches continue to hold their value.

Brand Heritage and Legacy

The heritage and legacy of luxury watch brands play a significant role in their potential. Brands like Rolex, Omega, and Patek Philippe have rich histories that span over a century. These brands have been worn by influential figures, adventurers, and celebrities, adding to their mystique and desirability.

For instance, the Omega Speedmaster became iconic after it was worn by astronauts during the Apollo moon missions. This association with historic events and personalities elevates the status of these watches, making them more than just timepieces—they become symbols of achievement and legacy. Investing in a pre-owned watch allows you to own a piece of this heritage, which can increase in value over time.

Market Demand and Trends

The market for luxury watches has seen steady growth over the years, driven by increasing global wealth and a growing appreciation for fine timepieces. The rise of online platforms and auction houses has made it easier for collectors and investors to buy and sell pre-owned watches, increasing market liquidity and transparency.

Market trends also influence the potential of luxury watches. For example, vintage and retro styles have seen a resurgence in popularity, driving up the value of older models. Additionally, collaborations between watch brands and other luxury entities, such as car manufacturers or fashion designers, often result in limited edition pieces that become highly coveted by collectors.

Diversification of Investment Portfolio

Vacheron Constantin Malte Tonneau Tourbillon

Adding pre-owned watches to your portfolio offers diversification, which can help mitigate risks associated with traditional assets. Unlike stocks or real estate, the value of luxury watches is not directly tied to market fluctuations or economic cycles. This independence from conventional markets provides a level of stability and can serve as a hedge against inflation and economic downturns.

Moreover, the tangible nature of luxury watches adds an element of security to your investment. Unlike digital assets, luxury watches can be physically owned, stored, and even worn. This tangible ownership can provide a sense of satisfaction and security that other assets may lack.

Expert Advice and Authentication

One of the crucial aspects of investing in pre-owned watches is ensuring their authenticity and condition. At Gray & Sons Jewelers, we provide expert advice to help you make informed investment decisions. Our team of experienced professionals meticulously inspects for authenticity each watch, ensuring that you receive a genuine and high-quality timepiece.

Additionally, our extensive network and industry knowledge allow us to source rare and sought-after watches, providing you with access to exclusive opportunities. Whether you are a seasoned collector or a first-time investor, our expertise and commitment to excellence ensure that you make a smart investment in pre-owned watches.

Conclusion

Investing in pre-owned watches is a smart and rewarding decision. The timeless appeal, retained and appreciated value, scarcity, quality craftsmanship, brand heritage, market demand, and diversification potential make luxury watches a valuable addition to any portfolio. At Gray & Sons Jewelers, we are dedicated to helping you navigate the world of pre-owned luxury watches, providing you with the expertise and guidance needed to make informed and profitable choices. Explore our collection today and discover the enduring value and elegance of pre-owned luxury watches.

Sell Us Your Jewelry

At Gray & Sons Jewelers, we understand that the world of luxury watches and fine jewelry is ever-evolving. That's why our sister company, Sell Us Your Jewelry, offers a seamless and trustworthy platform for selling your luxury items. Whether you’re looking to make room for new investments or simply wish to liquidate assets, Sell Us Your Jewelry provides expert appraisals and competitive offers for your pre-owned luxury watches and fine jewelry. With the same commitment to excellence and customer satisfaction, Sell Us Your Jewelry ensures a smooth and rewarding selling experience. Visit SellUsYourJewelry.com to learn more and start your selling journey today.

Exquisite Pre-owned Rolex Watches and Vintage Jewelry: New Arrivals at Gray and Sons - August 3, 2024

NEXT ARTICLE

Luxury Timepieces and Exquisite Jewelry: New Arrivals and Pre-owned Treasures at Gray and Sons (August 2, 2024)